Where is it profitable to open a current account for an individual entrepreneur and how much does it cost? Quick opening of a current account: where, how and why? Which bank is better to open a settlement bank?

A current account is an important and profitable financial instrument for every individual entrepreneur or founder of an LLC. It allows you not only to safely store funds, but also to organize, make the company’s financial transactions comfortable and fast. Opening and servicing such an account is paid, therefore, before choosing a bank, it is better to conduct a financial analysis of its additional services, tariffs, and bonus offers.

How to open a current account?

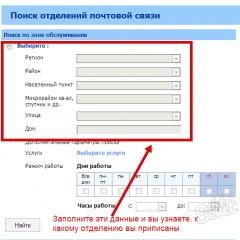

To open a current account, you need to contact a bank branch, fill out an application, provide a package of documents, and after signing the agreement, the account of the financial institution will be fully functional. This is a general procedure algorithm, but each bank has its own characteristics. For example, (as for an LLC) you can reserve an account number online (it immediately becomes available for accepting payments), and within 5 days present a package of documents and thereby ensure the full functioning of the account. The second and subsequent ones can also be opened without visiting the bank. VTB24 makes it possible to create them urgently within 4 hours, having a standard package of documents (but the service is paid - 2000 rubles). It is possible to open an account via the Internet and in Alfa-Bank, but it will remain inactive until a package of documents is provided (within a maximum of 14 days). It is better to choose a large bank with a good reputation. It should also be taken into account that although state financial institutions have a high level of reliability, the process of registration and verification of documents is very bureaucratic.

Advice: documents for opening a current account must be valid and reliable on the date of their presentation.

Current account for individual entrepreneurs: where is it more profitable to open?

Not all individual entrepreneurs necessarily need to open a current account. But for the correct conduct of business and convenient financial transactions, the procedure is necessary for almost all individual entrepreneurs, although the law does not oblige this. It is also important to go through. A current account allows you to safely store money, simplify the process of settlements with customers and suppliers, and interest is accrued on it at the end of each reporting period. If necessary, you will need to figure it out and pay for them, because closing a business does not write off debts to the state. It is also important to remember that in 2016 they will be paid at a rate of 22% in the Pension Fund, 2.9% in the Social Insurance Fund, 5.1% in the Federal Compulsory Medical Insurance Fund.

If the amount of transactions between an individual entrepreneur and a client is more than 100 thousand rubles, then it is simply necessary to register bank accounts. This can be done at any financial institution, but first it is important to analyze the tariffs, the proximity of the branch to the office, fees for cash withdrawals and payments.

What you need to pay attention to when choosing a bank to open a current account for an individual entrepreneur:

- Cost of opening and maintaining an account.

- Internet banking service, its cost.

- Features of opening accounts in foreign currency.

- Commission for conducting monetary transactions (withdrawal, transfer, deposit).

- Availability of additional services.

Advice: in 2016 it will be formed based on the cadastral value. It is paid on the basis of a notification from the tax office (clause 1 of Article 408 of the Tax Code of the Russian Federation).

Optimal conditions for opening and maintaining a current account for individual entrepreneurs have been created, in our opinion, in the following banks:

- Alfa-Bank (StartUp package, when paying for account maintenance immediately for 9 months, 3 months are provided free of charge, checking the reliability of counterparties before sending the payment, special offers for participants in public procurement).

- VTB24 (50% discount on additional services that were not included in the package during the validity period of the RKO package, RUB 2,000 bonus for contextual advertising in Google AdWords, profitable service packages for individual entrepreneurs - “Starter”).

- Rosselkhozbank (free account opening + remote banking services, moderate interest rate for cash withdrawal).

- Avangard (the first account is opened free of charge at the branch, a moderate commission for maintaining an account, free SMS information when choosing the “Basic” package, no commission for transferring funds to the account of an individual entrepreneur, a legal entity, or to funds for making mandatory payments).

- Tinkoff (Simple package - free account opening and two months of service, also in the absence of turnover).

Advice: Many beginning entrepreneurs are concerned about the question of... For a single tax, they are submitted in paper or electronic form once a year or quarterly, depending on the payer group. For a single social contribution (UST) - once a year.

In which bank should I open a current account for an LLC?

When registering an LLC, opening a current account is mandatory. In order to run your business profitably, it is better not to forget about some nuances, including the advantageousness of bank tariffs for creating and maintaining a current account. In addition, it is important to take into account the reputation of the financial institution, the distance of the branch from the office, the size of commissions, and the availability of legal support.

The best banks for opening an LLC current account:

- VTB24 (you can open an account in all regions of presence by contacting the branch once, package form of settlement and cash services - “VED”, “Business cash desk”).

- Avangard (free account opening, moderate fee for transferring funds - 30 rubles, free issuance of checkbooks).

- Tinkoff (moderate service fee - from 490 rubles, interest accrual on the account balance, interbank transfers until 21.00, free tax and budget payments).

Comparative table of bank tariffs

|

Bank |

Cost of opening an account (in rubles) | Cost of maintaining an account (in rubles) | Advantages | Opening dates |

Interest for cashing out |

| Sberbank | 2400 (RUB 700 for clients of the Small Business segment under certain conditions) | 2000 per month (for some categories of clients 700 rubles or free) | Online reservation of an account number, after which it is available for accepting payments | Up to 5 days | 0.65%-1.55% of the amount depending on the purpose, 1% for transfer to a card |

| VTB 24 | 2500 | 1100 | Urgent opening (within 4 hours), online application for opening (not available to all categories of clients) | 2-3 days | 0.6% -10% of the amount, budget transfers are free, interbank transfers - 30 rubles. |

| Alfa Bank | Free – 800 rub. | 1090-9900 depending on the tariff. StartUp package - in the absence of turnover, the service is free + no fee is charged for servicing 1 account in foreign currency (Alfa-Business Foreign Economic Activity package of services) | Online account opening, you can order a free meeting with a manager in a place convenient for the client | 1-3 days | Withdrawal for some packages is free, 0.6% of the amount, minimum withdrawal amount is 250 rubles. |

| Vanguard | Free for individual entrepreneurs, for LLCs using an online application to provide documents for opening the first account – 1000 rubles, urgent opening – 3000 rubles, at the stage of bankruptcy – 20000 rubles. | Free – up to 900 rub. depending on the category of clients | Online account opening, free connection to Internet banking | 1-2 days | Transfer is free, in some cases up to 150 rubles, withdrawal – 1.5-10% depending on the purpose |

| Tinkoff | For free | Free for the first 2 months and for individual entrepreneurs registered less than six months ago before the date of opening the first account, from the third month - 490 rubles. | Free Internet banking, favorable tariff packages for small businesses, individual entrepreneurs, additional services for individual entrepreneurs (tax certificates, issuance of personal and salary cards, insurance) | 2-3 days | 1.5% (minimum 99 rubles), transfer to a personal bank card up to 400 thousand - 0% |

In order to freely accept payments and make payment transactions, an individual entrepreneur must open a current account. How to open it, and where to do it?

Where and how to open an account for individual entrepreneurs

In accordance with the current legislation, individual entrepreneurs and companies do not have the obligation to open a current account in a bank. But this step can become indispensable in following cases:

- if an organization pays taxes non-cash, when an individual acting as a director or founder acts on its behalf;

- if an individual entrepreneur or enterprise plans to enter into an agreement, the amount of which exceeds the mark of 100,000 rubles;

- if individual entrepreneurs or organizations have a cash balance limit set (all funds the amount of which exceeds the established limit are subject to mandatory delivery to a banking institution for subsequent depositing into a current account).

Many individual entrepreneurs in practice use a current account even if they do not need it in the process of carrying out business activities. After all, this tool allows you to conveniently pay contributions and taxes. As for legal entities, they require a current account.

How much does it cost to open a PC for an individual entrepreneur?

Total cost includes the following directions:

- one-time commission payment spent on opening, copying constituent documentation, cards;

- commission paid to the bank for activating the service (its amount is set by the specific bank).

The cost of servicing the PC includes the amount of commission paid monthly, as well as the fee for withdrawing/depositing funds. An important role is played by the bank, tariff, and region of the Russian Federation.

List of documents

The list of documents is set specific financial institution. From January 1, 2016, there is no need to submit a certificate of registration to the Federal Tax Service and subsequent registration. Also, individual entrepreneurs were given the opportunity to open a current account remotely without the need to visit the bank in person. In general, the list of documents looks like in the following way:

- passport;

- a card containing original samples of signatures/seals;

- documentation serving as confirmation of the authority of the persons whose names are written on the card;

- licenses and patents.

In some cases, the bank may request additional papers, the availability of which will speed up the procedure for opening a personal account.

Notification of tax authorities and funds

Since May 2, 2014, clients who have opened a current account in a particular bank are required to report this fact to the tax office. This is stated in Federal Law No. 52 of April 2, 2014.

Previously, individual entrepreneurs had 7 days to contact the territorial tax office and submit a document in form C-09-1. From May 1, 2014, there was an obligation to notify the Pension Fund of the Russian Federation and the Social Insurance Fund within the framework of the norms of Federal Law No. 59 of April 2, 2014.

Review of the best banks for profitable opening (TOP 15)

To have an idea of the conditions offered by certain financial institutions, it is worth familiarizing yourself with them in more detail.

- Tochka bank. It offers three tariffs - “Required minimum”, “Golden mean”, “All the best at once”. The advantages include a high level of reliability and virtual customer service. The service package is completed in less than 1 hour. There is a discount on service for the first three months.

- Bank module. At the starter rate, both activation and maintenance are free. If you choose the best option, it implies a monthly fee of 690 rubles. The most expensive package has no limit and costs 4,900 rubles. An account can be opened in 5 minutes, the user gets access to a personal account, and funds are managed via a smartphone. All that is required from the individual entrepreneur is a passport.

- TINKOFF. Connection to all packages is free, and the cost of service depends on the range of services offered - 490 rubles, 1990 rubles. or 4990 rub. The grace period for service is 2 months. Payments are sent instantly. Your personal account can be ideally combined with accounting programs.

- LOCKO bank. The starter package is free. The OPTIMA tariff costs 990 rubles, and UNLIMITED costs 4990 rubles. Opening an account takes one minute; all documents can be sent via courier. The price for external payments is 19-59 rubles. depending on their type and character.

- Sphere (BCS). The service is social and is intended for entrepreneur clients. The cost of servicing the S tariff plan is 0 rubles, M – 990 rubles, L – 4990 rubles. per month Paid plans have a grace period of 3 months. The package includes the provision of many bonuses in the form of free accounting, documentation preparation, digital signature, and corporate card.

- PROMSVYAZBANK. Offers several packages, varying in price and set of included options. Internal payment transactions are free. You can receive information about completed operations via SMS.

- Sberbank. The organization offers 5 packages - from “Easy Start” for 0 rubles to “Great Opportunities” for 9,600 rubles. per month. The opening of a PC takes place in just 1 day, and funds are managed virtually. Payments can be made on any day, as there are no weekends. Cash withdrawal costs 0-8%, based on the amount.

- Expert Bank. There are three service packages. The most expensive one costs 4,790 rubles. The advantages of the service include the following aspects: quick room reservation, free cash issuance, 5% accrual on the balance.

- SOVCOMBANK. There are also 5 packages, each of which is free to connect to. Account maintenance depends on the selected tariff. “Together” costs 0 rubles, “Start” - 650, “Remote” - 1150. There are also two expensive programs - “Personal” for 1850 and “Profitable” for 3000 rubles. The cost of transfers is 15-50 rubles, you can work with a financial institution remotely.

- UBRIR. There are three packages. The price for payments is 28-89 rubles. The most expensive tariff includes 3 transfers per month, which can be made free of charge. Funds are deposited through an ATM.

- Alfa Bank. For individual entrepreneurs in terms of opening a current account, the organization offers the maximum number of opportunities - 6 packages. You can manage finances, as in other situations, remotely.

- Delo Bank. Designed to interact with the business sector. Its tariffs are the most favorable. For example, there is a package “Profitable Start” for 0 rubles, as well as “Active Growth” for 990 rubles. A list of expanded tariff options is also provided.

- ROSBANK. There are no free packages here, but there are affordable paid offers. The cheapest tariff costs 590 rubles. The most expensive is 3990 rubles. Opening a personal account account in this bank is associated with certain features. The invoice is issued one day in advance. Internet banking is offered free of charge on any tariff plan.

- Opening. Great business opportunities. You can manage funds remotely. Clients have access to urgent payments and access to their personal account 24/7.

- RAIFFEISENBANK. This organization offers several tariff packages. For example, “Start” for 490 rubles, “Basic” for 1900 rubles. Subscription fees are charged exclusively at the two largest tariffs, which are called “Optimum” and “Maximum” respectively.

What should you rely on when choosing a bank?

Choosing a bank is a complex and responsible task that requires a competent approach. Plays an important role taking into account the following factors and criteria:

- location close to the place of commercial activity;

- affordable tariff offers;

- large selection of packages;

- quality of service (speed, treatment of visitors, provision of consulting support, etc.).

You need to select several organizations in the area where the office is located, and then familiarize yourself in detail with the conditions that they offer.

Hello, dear readers! I came up with the idea a long time ago to write a review article about where and in which bank to open a current account for individual entrepreneurs and LLCs and to collect in it all the interesting offers on banks providing such a service. Therefore, keep a list of the best, in my opinion, banks for opening a current account. I contacted bank representatives and received information from most.

Criteria for evaluation

I propose to evaluate the banks listed below according to the following criteria in order to determine where it is profitable, safe and convenient to open a current account:

- Cost of opening a current account.

- Maintenance cost (monthly).

- Account opening deadlines.

- Internet banking (availability and cost).

- Mobile bank (availability and cost).

- SMS notification (availability and cost);

- Operation day.

- Commission for non-cash payments legal. persons.

- Possibility of transferring physical persons to regular bank cards/accounts (commission).

- Cash withdrawal through ATMs (commission).

- Cash.

- Number of free plastic cards.

- Synchronization with online accounting “My Business” and “Elba”, etc.

- Interest on account balance.

If you have a suggestion to expand the list of criteria, write in the comments, we will try. I couldn’t fit all the banks into one table on the website, so let’s go through all the banks one by one.

List of banks

Important We did, i.e. have tariffs without a monthly subscription fee.

We will divide the list into classic “veteran” banks, and into more modern and technological ones.

We consider the following to be “veterans”:

- Sberbank.

- Alfa Bank.

- Promsvyazbank.

- Loko-Bank.

Towards more modern and technologically advanced banks:

- Tinkoff.

- Modulbank.

- Tochka (based on Otkritie and Qiwi banks).

- DeloBank (based on SKB Bank).

If the first group of banks is known to everyone, then the second group is still little known, but I will tell you with full responsibility that I would recommend looking in the direction of the second group. Below we will compare and in conclusion we will draw conclusions on where to open a current account for individual entrepreneurs and LLCs is profitable, safe, convenient, etc.

Open a current account at Tinkoff Bank

- Cost of service (monthly) - the first 2 months are free, then at the "Simple" tariff - 490 rubles. per month, “Advanced” - 990 rub., “Professional” - 4990 rub. per month. If there were no account transactions in a month, then this month is free.

- Account opening time - you can use it in 5 minutes.

- Operating day - from 7:00 to 21:00 Moscow time.

- Commission for non-cash payments legal. persons - according to the “Simple” tariff, 3 payments are free, the rest - 49 rubles. per payment, according to the “Advanced” tariff, 10 payments are free, the rest - 29 rubles. per payment, according to the “Professional” tariff - 19 rubles per payment. Unlimited payments on the “Simple” tariff – 490 rubles, on the “Advanced” tariff – 990 rubles, on the “Professional” tariff – 1990 rubles. per month.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes, on Tinkoff Bank cards without commission.

- Cash withdrawal through ATMs (commission):

— According to the “Simple” tariff: up to 400,000 rubles. — 1.5%, up to 1,000,000 rub. - 5%, from 1,000,000 - 15%. With each withdrawal, an additional 99 rubles are withdrawn.

— According to the “Advanced” tariff: up to 400,000 rubles. — 1%, up to 2,000,000 rub. - 5%, from 2,000,000 - 15%. With each withdrawal, an additional 79 rubles are withdrawn.

— According to the “Professional” tariff: up to 800,000 rubles. — 1%, up to 2,000,000 rub. — 5%, from 2,000,000 rub. - 15%. With each withdrawal, an additional 59 rubles are withdrawn. - Cash:

— At the “Simple” tariff: 0.15%, minimum 90 rubles.

— According to the “Advanced” tariff: up to 300,000 rub. free, from 300,000 rub. — 0.1%, minimum 79 rub. , 3 refills per month - 990 rubles, per year - 9900 rubles.

— According to the “Professional” tariff up to RUB 1,000,000. free, from 1,000,000 rub. — 0.1%, minimum 59 rub. 5 top-ups without commission - 1490 rub. per month, 14,900 rub. in a year. - The number of free plastic cards is 0 rubles, one corporate and salary cards or two corporate and salary cards, depending on the tariff.

- The interest on the account balance is up to 6%.

You can open an account at bank website.

A small conclusion on the bank's proposal. Oleg Tinkov is at his best as always. It has always been famous for the best service. One of the longest operating days, money is transferred instantly, cool mobile application and Internet banking, up to 6% per annum on account balance, opening without visiting the bank, the first 2 months are free, telephone support 24/7, you can withdraw cash almost at any ATM and much more.

Soon there will be such features as reminders about upcoming taxes, submitting reports to government agencies, checking partners and counterparties, currency payments and friendly currency control, templates for regular payments, etc.

Open a current account in Modulbank

- The cost of opening a current account is free.

- Cost of service (monthly) - first tariff - 0 rubles, second tariff - 490 rubles, third tariff - 4500 rubles. per month.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free.

- Operating day: 9.00 – 20.30.

- Commission for non-cash payments legal. persons - 90, 19 and 0 rub. (in order of tariffs listed).

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes. For individual entrepreneurs, depending on tariffs: 0.75% up to 300,00 rub., 19 rub. up to 500,000 rub., about rub. up to 1,000,000 rub. For LLC, depending on tariffs: 0.75% up to 100,000 rubles, 19 rubles. up to 200,000 rub., 0 rub. up to 300,000 rub.

- Cash withdrawal through ATMs (commission): from 0 to 20% depending on the withdrawal amount.

- Cash deposit: from 0 to 2.7%.

- The number of free plastic cards is 1 to 5, depending on the tariffs.

- Synchronization with online accounting “My Business” and “Elba”, etc. - There is.

bank website.

A small conclusion on the bank's proposal. The bank has a free tariff plan. Modulbank operates on the basis of the Regional Credit bank, which is more than 23 years old, with a convenient mobile application and Internet banking, cash withdrawal to any bank card with low commissions. And, as a representative of the bank said, all current accounts are insured for 1.4 million rubles, which makes us believe in its reliability. By the way, its founder is the former head of the business department at Sberbank, Yakov Novikov. I don’t see any downsides yet, just like Tinkoff Bank.

Open a current account at Tochka Bank

- The cost of opening a current account is free.

- Cost of service (monthly) - depending on the tariff, from about to 2500 rubles.

- Account opening time - you can use it in 5 minutes, and complete registration - 1 day.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free.

- Operating day - from 00.00 to 21.00 Moscow time.

- Commission for non-cash payments legal. for persons - on the free tariff - payments are free, on the other two 10 and 100 are free, in addition to the package - 60 and 15 rubles.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes.

— Up to 200,000 or up to 500,000 rubles. free of charge depending on tariffs for individual entrepreneurs.

— Up to 100,000 or up to 300,000 rubles. free of charge depending on tariffs for LLC.

— With the free plan, translations are free for individual entrepreneurs and LLCs. - Cash withdrawal through ATMs (commission): free of charge on the free tariff, up to 50,000 rubles on the second tariff. - 1.5%, over - 3%, at the third tariff - up to 100,000 rubles. free, above - from 1.5 to 3% depending on the amount.

- Cash deposit: on a free tariff - up to RUB 300,000. 1%, over - 3%, on the second tariff any amounts - 0.2%, on the third - up to 1,000,000 free, over 0.2%.

- The number of free plastic cards is from 2 to 6 free depending on the tariff.

- Interest on the account balance is not provided. There is a tax cashback of 2%.

bank website.

A small conclusion on the bank’s proposal: Convenient mobile application, and Internet banking, the longest operating day, transfers within Tochka around the clock, transfers to individuals. persons without commissions, created on the basis of Otkritie Bank, which has been on the market for a long time.

Current account in Expert Bank

- The cost of opening a current account is free.

- Cost of service (monthly) - depending on the tariff, from about to 3990 rubles.

- Account opening time - you can use it in 5 minutes, and complete registration - 1 day.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free.

- Operating day - from 09.00 to 17.00 Moscow time.

- Commission for non-cash payments legal. persons: 0, 18 and 78 rub. depending on the tariff.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - no information.

- Cash withdrawal through ATMs (commission): free withdrawal is not provided for the free tariff. On paid ones - up to 100,000 and 700,000 rubles. for free. The maximum withdrawal amount is $15,000.

- Cash deposit: 0.1%, free at the maximum rate.

- The interest on the account balance is up to 5%.

You can open a current account at bank website.

A small conclusion on the bank's proposal. Expert Bank is the largest in the Omsk region and has branches in several cities of Russia. There is a free tariff, online account reservation, the bank does not limit the volume of payments, offers a modern Internet bank and increased limits on cash withdrawals from corporate cards. When making an advance payment for service, you can get a 10% discount.

Current account in Promsvyazbank

- The cost of opening a current account is 0 rubles.

- Maintenance cost (monthly) - from 0 to 2,290 rubles. depending on the tariff.

- Account opening time is 1 day, reservation 10 minutes in advance on the official website when submitting an online application.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, from 0 to 199 rubles. depending on the tariff.

- Operating day - from 9.00 to 21.00.

- Commission for non-cash payments legal. persons - from 3 to 200 pcs. free, over the limit - from 19 to 110 rubles. depending on the tariff.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes, from 0.1 to 10% depending on the amount. An additional charge ranges from 18 to 350 rubles. depending on the tariff.

- Cash withdrawal through ATMs (commission) - 1.2% on average;

- Number of free plastic cards - all cards are paid. You can produce any quantity costing from 200 to 990 rubles. per month per card.

- Synchronization with online accounting “My Business” and “Elba”, etc. - yes! And what’s more, when you open an account, you get 3 months of accounting as a gift.

You can read the terms and open an account at official website of Promsvyazbank.

A small conclusion on the bank's proposal. Promsvyazbank is a systemically important bank in the Russian Federation, which indicates its reliability. Moreover, in recent years the bank has become more modern and is constantly developing. Definitely, he deserves you to open a current account with him!

- The cost of opening a current account is free.

- Cost of service (monthly) - from 0 to 8,000 depending on the tariff.

- Terms for opening an account - the account will be ready in 5 minutes, complete registration - 1 day.

- Internet banking (availability and cost) - yes, included in the price.

- Mobile bank (availability and cost) - yes, included in the price.

- SMS notification (availability and cost) - yes, at the maximum tariff - free, at the rest - 60 rubles. for each card.

- Operating day - from 09.00 to 18.00 Moscow time.

- Commission for non-cash payments legal. persons: free - 3, 5, 10, 50 and 100 pcs. depending on the tariff. Over the limit - from 16 to 100 rubles.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes. For LLC - 0.5%. At the maximum tariff 300,000 rub. free, then 1.5%. For individual entrepreneurs - 150,000 rubles. free, then 1%. At the maximum tariff - 300,000 rubles. free, then 1.5%.

- Cash withdrawal through ATMs (commission): at a free rate of 3%, at a maximum rate - 500,000 rubles. free, then 1.4%. At other tariffs - 1.4%.

- Cash deposit: on a free tariff - from 0.15 to 0.36% depending on the tariff and amount. You can deposit from 50,000 to 500,000 rubles for free. With the free plan, you can deposit cash only with a commission.

- The number of free plastic cards is up to 5. Free service only in the first year. From the second - 2,500 per year.

- Synchronization with online accounting “My Business”, “Elba”, etc. is available.

- The interest on the account balance is up to 3%.

You can open a current account at bank website.

A small conclusion on the bank's proposal. Not long ago, Sberbank developed a new line of tariffs, and now entrepreneurs have access to a free package of services. The bank holds promotions for new clients, so you can get 1 or 3 months of service as a gift. Each tariff provides free payments, and if you open a savings account, interest will be accrued on the account balance.

Open a current account with Alfa Bank

- 0 rub. opening an account and connecting to Internet banking.

- 0 rub. Internet banking and mobile banking for account management.

- 0 rub. issuing a business card for depositing and withdrawing cash at any ATM.

- 0 rub. tax and budget payments.

- Maintenance cost (monthly) - from 490 rubles. up to 9,900 per month.

- Commission for non-cash payments legal. individuals - from 3 payments to 30 payments free of charge. At the maximum tariff, all payments are 0 rubles. Over the limit - from 16 to 50 rubles. depending on the tariff.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes. From 100,000 to 500,000 rub. free depending on the tariff. Over the limit - from 1 to 10% depending on the tariff.

- Cash withdrawal through ATMs (commission) - from 50 to 500,000 rubles. free depending on the tariff, over the limit - from 1 to 10%.

- There is synchronization with online accounting “My Business” and “Elba”, etc.

- There is no interest on the account balance, but you can get cashback on taxes of up to 3%.

Additional bonuses:

- 3,000 rub. for advertising on Google.

- 9,000 rub. for advertising in Yandex.

- up to 50,000 rub. for promotion on social networks.

- Access to all working tools “Bitrix24”, “My Business”, “Contour” for six months free of charge.

- Certificate for recruitment in HeadHunter.

You can open a current account at bank website.

A small conclusion on the bank's proposal. Just like in Sberbank, you can choose for reliability. But the tariffs are less favorable than in Sberbank: there is no free tariff, a small number of free payments and high commissions for physical transfers. persons. Among the advantages of the bank: cashback on taxes, gift certificates for partner services and convenient online banking.

Current account in LOCKO-Bank

- The cost of opening a current account is free.

- Maintenance cost (monthly) - 0, 990, 4,990 rubles. depending on the tariff.

- Terms for opening an account - reservation within a minute, full registration - within 24 hours.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, from 150 to 250 rubles. per month, at the maximum tariff - free.

- Operating day - from 9.00 to 19.00.

- Commission for non-cash payments legal. persons - 19, 29 and 59 rubles. depending on the tariff.

- Possibility of transferring physical persons to ordinary bank cards/accounts (commission) - yes, for individual entrepreneurs up to 150,000 rubles. to your account for free, in other cases for individual entrepreneurs and LLCs with a commission from 2 to 10% depending on the amount.

- Cash deposit - from 0.07 to 0.3% depending on the amount and tariff. At the maximum tariff there is a free deposit.

- There is synchronization with online accounting “My Business” and “Elba”, etc.

- There is no interest on the account balance.

You can submit an application and open an account at official website of Loko-Bank.

A small conclusion on the bank's proposal. Loko-Bank offers a free tariff, functional mobile and Internet banking. There is fast online account reservation. But in terms of the cost of SMS information and payments, the bank loses to its competitors.

Current account at Eastern Bank

- The cost of opening a current account is free.

- Maintenance cost (monthly) - from 490 to 9,990 rubles. depending on the tariff.

- Account opening time: reservation within 5 minutes, full registration within 24 hours.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free. Extended version - 250 rub. for the first issue, 100 rubles. - for the next 2.

- Operating day - from 9.00 to 23.00.

- Commission for non-cash payments legal. individuals - 5 and 20 payments free of charge, above the norm - from 16 rubles. There are plans with free payments.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - yes, up to 150,000 rubles. free, up to 500,000 rub. — 0.5%, over 500,000 rub. - 1%.

- Cash withdrawal through ATMs (commission) - no information.

- Depositing cash is free.

- Number of free plastic cards - no information.

- There is synchronization with online accounting “My Business” and “Elba”, etc.

- There is no interest on the account balance.

You can find out detailed tariffs and open an account at official website of Vostochny Bank.

A small conclusion on the bank's proposal. Vostochny Bank offers free account reservation, full-fledged Internet banking and extended operating hours. You can transfer money to a personal card without commission, and the cost of payment is one of the lowest among banks.

Current account in DeloBank

DeloBank is a service from the well-known SKB Bank, which has been successfully operating in the banking services market for a long time.

- The cost of opening a current account is free.

- Cost of service (monthly) - depending on the tariff, from about to 7590 rubles.

- Account opening time - you can use it in 10 minutes, and complete registration - 1 day.

- Internet banking (availability and cost) - yes, free.

- Mobile bank (availability and cost) - yes, free.

- SMS notification (availability and cost) - yes, free.

- Operating day - from 09.00 to 21.00 Moscow time.

- Commission for non-cash payments legal. persons: on the free tariff, all payments are 87 rubles, on the rest there are 10, 100 and an unlimited number of free payments depending on the tariff, payments over the limit - 25 rubles.

- Possibility of transferring physical to persons on regular bank cards/accounts (commission) - up to RUR 50,999.99. free, then with a commission, above - from 1 to 10% depending on the amount.

- Cash withdrawal through ATMs (commission): 2% at SKB Bank and partner ATMs, 3% at other ATMs.

- Cash deposit: up to 50,000, 200,000 rub. free depending on the tariff, at the maximum tariff unlimited amounts are free, over the limit - from 0.1 to 0.3% depending on the tariff.

- The number of free plastic cards is 1.

- Synchronization with online accounting “My Business”, “Elba”, etc. is available.

- The interest on the account balance is up to 5%.

You can open a current account at bank website.

A small conclusion on the bank's proposal. DeloBank is a new online branch of SKB Bank with a convenient personal account. There is a free tariff, interest on the balance, you can deposit cash and transfer money to individual accounts for free. persons Depending on the connected tariff, you can get 1 or 2 months of service as a gift. And if you pay in advance, DeloBank will provide a discount from 5 to 20%.

Conclusion

If you are just starting out or have a micro-business with a small turnover, then the following are ideal for you:

- Modulbank(free plan).

- Dot(cool service).

- Tinkoff Bank(free 2 months and cheap tariff 490 RUR).

- (there is a free plan).

- (there is a free plan).

If you really like to choose, you can open accounts in both and compare for yourself which is better. It's free anyway ;)

If your turnover is higher (from 1 million rubles per month), then you can use the first 4 (Tinkoff, Modulbank, Expert Bank and Tochka), and you can also consider:

- Promsvyazbank.

- Alfa Bank.

- Sberbank.

- Oriental.

Conclusion

In conclusion, I want to say that the choice is yours. Personally, I believe that the future belongs to technology companies. If you have your own evaluation criteria, write in the comments, you can also suggest other banks for review, but only if they are really better in terms of conditions than those listed in the article. I would also like to ask you to write reviews about the banks where you have current accounts, what you like, what you don’t like, etc.

I hope that the article helped you in choosing a bank to open a current account for an individual entrepreneur or LLC.

Hello, dear readers! Igor Eremenko, entrepreneur and author of the SlonoDrom.Ru resource, is in touch. Today we will talk about where it is more profitable to open a current account for an individual entrepreneur or LLC in 2019.

Several years ago, when opening an individual entrepreneur for the first time, I was faced with the question: in which bank to open a current account. If you have already opened or are just planning or, then most likely you have also asked yourself this question.

In this article I will present to your attention a detailed overview of the tariffs of reliable banks for opening and servicing a current account.

After reading the article you will learn:

- What important criteria do banks need to present when opening a current account?

- What fees and tariffs are established for banking services for a current account?

- Which bank is better to open a current account?

So, let's find out which bank provides the best conditions for business owners! 🙂

1. Criteria for choosing a bank to open a current account

When choosing a bank, we will be guided by the following key criteria (the higher the criterion, the more significant it is):- Bank reliability

- Cost of service (tariffs and commissions)

- Availability and functionality of Internet banking

- Opening cost

- Interest on balance

I. Bank reliability is one of the important criteria that must be taken into account. Since the funds of legal entities in bank accounts are not insured, in the event of a bank bankruptcy, you can permanently lose all your money. Recently, it is no longer uncommon for the Central Bank to revoke the licenses of commercial banks.

Important!

One of my friends lost more than 3 million rubles. in one of the banks as a result of its bankruptcy. Neither the state nor the bank returned this money.

II. Maintenance cost— includes commissions, monthly and additional payments for servicing the current account. One of the important criteria along with the reliability of the bank.

Personal experience:

When I opened a current account for the first time, I noticed that most banks have almost no different functionality, but the price for services differs several times. Therefore, it makes no sense to overpay for the services of a current account (especially when the business is not yet making money)!

III. Availability and functionality of Internet banking. Since in modern times any payment transaction can be carried out via the Internet without visiting the bank and waiting in queues, the presence of Internet banking is a very important addition to the current account.

The functionality of online banking is also important, so that it is clear and easy to use.

IV. Opening cost- This is a one-time amount of money paid for opening a current account. On average, the cost of opening a current account ranges from 500 to 2,000 rubles. Some banks do not charge money at all for opening a bank account. Not the most important criterion, but it is also worth considering.

V. Interest on balance- this is the monthly amount accrued on the account balance according to the current interest rate. A good addition to your current account so that your money always works.

Even 2-8% interest per annum can provide good additional income!

2. Which bank is better to open a current account for an individual entrepreneur or LLC in 2019: TOP 8 banks - review of tariffs

For all tariff plans.

For free: mobile and internet banking, SMS info, salary and corporate cards.

The operating day is almost a day: from 1 to 20 hours Moscow time.

A current account is opened online in 3 minutes, all necessary documents will be delivered to your home or office free of charge.

+ there is built-in free accounting!

Eat. Great.

One of the best online banks in Russia. Clear and simple interface. Fast processing of transactions. Completely free. Additional partner bonuses are provided: for advertising, online accounting, corporate communications...

IV. Opening cost. For free.

V. Interest on the balance. Eat. High.

Tariff "Simple" - up to 4% on the balance. Tariff “Advanced” and “Professional” up to 6% on the balance.

You can go to the bank’s website and find out all the benefits of a current account

2. Modulbank

is a medium-sized bank that works exclusively with small businesses. It has good conditions for servicing current accounts.I. Reliability — 4 out of 5 points. Above average.

The bank has existed since 1992. Stable bank. Since 2016, it has been working only with small businesses. Commercial bank, without the participation of state capital. Sovcombank owns 24% of the shares.

I I. Cost of maintenance. Low.

There are 3 tariffs to choose from:

1. Starting — 0 rub.

— Free payments are not provided. Carrying out 1 payment transaction will cost 90 rubles.

— The commission for withdrawals depends on the withdrawal amount: 1% (up to 100 thousand rubles), 3% (from 100,001 to 300,000 rubles), etc. Depositing funds at Modulbank offices and ATMs is free, through other banks - according to the commission of a third-party bank.

— Transfer to cards/accounts of individuals — 90 rubles.

— One free corporate card.

2. Optimal - 490 rub.

— Making 1 payment will cost 19 rubles.

— When withdrawing cash up to 50,000 rubles/month. there is no commission, up to 300,000 - 1% commission, up to 500,000 - 3% commission, etc. Depositing money into a current account at Modulbank offices and ATMs is free; through other banks and ATMs, third-party bank commissions are charged.

— Transfer to cards/accounts of individuals — 19 rubles.

— Corporate cards — 2 free.

3. Unlimited - 3,000 rubles.

— Unlimited number of non-cash payments.

— For withdrawals up to 100,000 there is no commission, up to 500,000 - a 1% commission, up to 1 million rubles - a 5% commission, over 20%. There is also no commission for depositing funds, provided that the deposit is made at the offices and terminals of Modulbank and its partners.

— Free transfers to cards/accounts of individuals.

— 5 free corporate cards.

For all tariff plans.

Free Internet bank,mobile banking, SMS notification.

Operating day: from 9 to 20:30. Payments are credited in 10 minutes.

It is also possible to open a current account via the Internet and immediately receive its number. The contract will be delivered to you at any convenient time.

III. Availability and functionality ь Internet banking. Eat. Great.

Modern, clear and simple online banking. One of the best.

IV. Opening cost. For free.

V. Interest on the balance. Eat. Average.

No interest is accrued on the “Start” tariff, 3% on the balance on the “Optimal” tariff, and 5% on the “Unlimited” tariff.

You can find out more about the current account in ModulBank!

3. Ural Bank for Reconstruction and Development

is another popular bank that provides free conditional services for a current account.

is another popular bank that provides free conditional services for a current account.

I. Reliability — 4 out of 5 points. Above average.

The bank was founded back in 1990, one of the largest banks in the Urals. Included in the TOP-50 credit institutions in Russia. Without the participation of state capital.

II. Maintenance cost. Below average - Average.

Tariff conditions vary significantly in different cities. Generally, in large cities with a population of over a million, service tariffs are significantly higher than in other cities of the country. At the same time, in cities with a population of over a million, there is no possibility of free service.

The bank offers a lot of tariffs, we will look at the 2 most optimal ones.

1. Tariff “Everything is simple” - 0 rub. (from 300 rub./month in large cities)

— The cost of one payment is 55 rubles (without subscription fee) and from 22 rubles. (if you have a subscription fee).

— Cash withdrawals through UBRD ATMs — 1%, through ATMs of third-party banks — 3%. Depositing cash in some cities is free, in others from 0.1%.

— 1 free corporate card.

— SMS notification — 39 rubles/month.

2. “Online” tariff - from 350 rubles/month

— Making 1 payment costs from 19 rubles. depending on the city.

— The commission for cash withdrawal is the same: 1% at UBRD ATMs, at other ATMs — 3%. The commission for depositing funds into an account depends on the city, in most cases it is free, in others it is from 0.1%.

— One corporate card is free.

— SMS notification — 39 rub./month.

For all tariffs.

Free Internet banking,mobile bank (view transactions).

Operating day: from 9 to 18:30.

You can submit an application for opening a current account via the Internet, and a bank specialist will come to you at a convenient time to complete the documents.

III. Availability and functionality of Internet banking. Eat. Average level.

Internet bank is average in terms of functionality.

A huge drawback is the virtual absence of a mobile bank. Through it, you can only view account transactions, but to create a payment transaction you will have to use the full version of Internet banking.

IV. Opening cost. For free. In some cities and tariffs - from 700 rubles.

V. Interest on the balance. No.

No interest is charged on the balance.

1.2 Current account in the largest banks in Russia - TOP 5 banks

Now let’s move on to a review of the well-known and largest banks in the country: Sberbank, VTB24, Alfa-Bank.

The reliability of these banks is the highest, since they are for the most part key in the Russian financial system, and their bankruptcy will mean that there are very serious problems in the entire economy. Moreover, even in conditions of a deep crisis, they will be financially supported by the state.

As you yourself already understood, the risks of bankruptcy of such banks are extremely small. However, with regard to the cost of service, the price, as a rule, is an order of magnitude higher than that of “second” tier banks.

1. Sberbank

4. Bank Tochka (Opening)

5. Conclusion

In any case, when choosing a bank, proceed from your own preferences and needs. If you have already had experience working with banks and have something to share, leave your opinion and feedback in the comments below.

Also, if you found more favorable conditions in other banks, write about it, I will definitely make a review and add it to the article.

That's all for me! I wish you successful business!

Information updated: 05/28/2019

This is the first article about the life of a beginning individual entrepreneur. Yesterday I submitted documents to the tax office and began to choose the best bank for an individual entrepreneur. That's what came out of it.

It turned out that the information on the Internet is either irrelevant or too promotional with a lot of footnotes and asterisks. To understand this, I had to read 28 pages of the Banki.ru forum, several topics on automotive and SEO forums, and study the TOP 10 articles from Yandex and Google for the query “bank for individual entrepreneurs.”

I realized that it was difficult to find up-to-date information on the Internet, and decided to call all the banks myself. Based on the articles I read, I compiled a list of 20 banks that I began calling to find out accurate information.

You can open a current account at any time after registering an individual entrepreneur, but it is better to do this as early as possible. An aspiring entrepreneur will be able to use it to accept and send any payments, cash and non-cash, and use his card for personal needs. After your business expands, you will be able to enable the acceptance of non-cash payments in terminals or on the Internet, conduct transactions in foreign currency and issue salaries to your employees on cards.

You can open an account in any bank you like, regardless of your place of registration or business registration. You can submit an application online or at a bank branch.

Introduction to my business

- Many receipts to the current account from individuals

- Transfer money once a week to your card in Alfa-Bank

- Payment by invoice - only mandatory payments to the tax office and the Pension Fund of Russia

- simplified tax system 6%

My requirements for the bank

- Low prices for opening and maintaining an account

- Internet banking, with support for modern browsers, including Safari for Mac

- SMS notifications about transactions (receipt of money, making payments)

- Mobile application for iOS (preferably)

Of the 39 banks I called, I chose 15 banks with the most profitable and interesting offers.

I also found out what documents need to be submitted to the bank to open an account. The package of documents includes:

- Passport

- Extract from the Unified State Register of Individual Entrepreneurs or certificate of registration of an individual entrepreneur

- Entrepreneur's TIN

All documents must be submitted in original form. Bank employees will take and certify copies of them themselves.

After this, you need to fill out an application (if you have not done so previously) and sign agreements for opening accounts. Then wait for notification that your application has been reviewed and an account has been opened. You will immediately receive details that can be entered into all documents and databases.

1 place. Winner. Tochka (FC Otkritie/Qiwi Bank). Tariff "Required minimum"

1 place

Tochka positions itself as “the best bank for entrepreneurs.” After its appearance, many businessmen servicing Avangard Bank moved to Tochka. There are many discussions on this issue on the forums. For all its clients, the bank offers a favorable tariff with free (!) service and special offers from the bank’s partners. The point is part of a unique interbank project organized by Otkritie Financial Corporation and Qiwi Bank. You can choose which bank balance you want to be serviced on - the conditions do not change.

In addition, Tochka launched an online registration service for individual entrepreneurs. To use it, just leave a request and upload scans or photos of documents. Bank specialists will draw up an application themselves and submit it to the tax office, select OKVED activity codes and open a current account. You will only need to pay the registration fee and sign a current account agreement with the manager.

The point operates in all major cities of Russia and almost all regions.

The bank is suitable for both new and long-existing individual entrepreneurs.

The bank offers everything necessary for individual entrepreneurs.

The point operates on the basis of two large Russian banks.

- Cost per month for free

- Opening cost for free

- for free

- Transfers to individuals for free

- Internet banking

- SMS notification 90 rubles per month for each number

- iOS app There is

- Login to Internet Banking

- Cash withdrawal for free

- Account registration online with a specialist visiting

- Additionally online registration of individual entrepreneurs - free (including state duty)

- Bonuses when opening an account 50,000 rubles for promotion in social networks in myTarget, 10,000 rubles for promotion in Yandex.Direct, 3,000 rubles for promotion in Google.Adwords

Advantages

- Free salary and corporate cards

- Assistance in registering individual entrepreneurs

Flaws

- Small Business Only

2nd place. Promsvyazbank. Tariff "Business Start"

2nd place

A large bank with state participation, recognized by the Central Bank as one of the systemically important ones. It is one of the three largest commercial banks in Russia, so you don’t have to worry about revoking your license. The starting tariff from PSB is suitable for all small and newly opened individual entrepreneurs for whom it is important to save on opening and maintaining an account.

You can open a current account in many large cities - Moscow, St. Petersburg, Yekaterinburg, Volgograd, Chelyabinsk and others.

The account is opened and serviced completely free of charge.

You can open an account without visiting the bank.

The bank returns to its previous position after reorganization.

The account is easy to manage via Internet banking.

- Cost per month for free

- Opening cost for free

- Cost of payment order 3 per month - free, then - 100 rubles

- Transfers to individuals up to 150,000 rubles - free, then - from 1.5%

- Internet banking

- SMS notification 99 rubles per month

- iOS app There is

- Login to Internet Banking USB key

- Cash withdrawal from 3%

- Additionally business loans with fast online processing

- Account registration

- Bonuses when opening an account No

Advantages

- Completely free service

- Business loan after opening an account

- Preparation of documents for opening - free of charge

Flaws

- You cannot open an account in foreign currency

3rd place. Tinkoff Business. Tariff "Simple"

3rd place

A new product for entrepreneurs from a well-known bank. To open a current account, you don’t have to travel anywhere—the manager will come to your office with documents and a bank card. The service conditions are quite comfortable for an individual entrepreneur.

Like Tochka, Tinkoff operates in almost all cities of Russia.

The terms of service at Tinkoff are quite convenient for individual entrepreneurs.

The account is completed entirely online.

A fairly stable online bank.

All transactions with the account are carried out online.

- Cost per month 490 rubles (2 months free for new clients, 3 for clients of closed banks, 6 for newly registered individual entrepreneurs)

- Opening cost for free

- Cost of payment order 3 payments for free, subsequent payments for 49 rubles, unlimited when connecting to the “Interbank - no commission” package (490 rubles per month)

- Transfers to individuals from 1.5 to 15%, to a personal Tinkoff Black card - free

- Internet banking yes, free (support for new browsers, including Safari for Mac)

- SMS notification There is

- iOS app There is

- Login to Internet Banking login with password and confirmation code via SMS

- Cash withdrawal from 1.5% to 10%

- Interest on balance 4% per annum

- Account registration online with a specialist visiting

- Bonuses when opening an account Help with promotion in Yandex.Direct, myTagret, Google AdWords and Youtube, 3 months. free use of the Elba and Moe Delo service, 45 days of using “1C: Entrepreneur” for free

Advantages

- Account details after completing the application

- Interest on account balance

- Free accounting for the simplified tax system and UTII

Flaws

- Expensive payment orders

4th place. Modulbank. Tariff "Optimal"

4th place

The project from people from Sberbank is positioned as a bank for small businesses. Convenient website, technical support with a human face, all operations via Internet banking and mobile application. For an individual entrepreneur, he has an inexpensive tariff with all the necessary functions. After talking with a consultant and studying the forums, I concluded that this bank is best suited for entrepreneurs according to the criteria stated in my requirements.

The bank operates in 50 regions of Russia, including Moscow, St. Petersburg, Novosibirsk, Kazan, Rostov-on-Don, Krasnodar and Sochi.

The bank offers convenient conditions for small businesses.

The account is completed entirely online.

The bank offers the entrepreneur everything he needs.

A fairly stable and reliable bank.

All transactions with the account are carried out online.

- Cost per month 690 rubles, 0 - if card expenses per month are from 100,000 rubles

- Opening cost for free

- Cost of payment order 19 rub.

- Transfers to individuals up to 500,000 rubles - according to the payment tariff, then from 1%

- Internet banking yes (support for new browsers, including Safari for Mac)

- SMS notification 90 rubles

- iOS app There is

- Login to Internet Banking login and password with confirmation code from SMS

- Cash withdrawal Up to 50,000 rubles - free, then - from 2.5%

- Account registration online with a specialist visiting

- Bonuses when opening an account gifts from Yandex, My Business, Kontur.Elba, OZON and other services; 4 months of virtual telephony + free landline number; discount 5,000 rub. for the first lease payment

Advantages

- Free account maintenance for card expenses over 100,000 rubles per month

- Savings accounts and deposits

- Loans and overdraft with instant processing

Flaws

- Expensive payment orders

5th place. Loko-Bank. Tariff "Start"

5th place

A fairly large and reliable bank that may not be afraid of having its license revoked in the near future. He is very actively developing his products - both for private and corporate clients. Its tariff is interesting due to its free service and fairly inexpensive payment orders.

The bank is present in a number of large cities in the European part of Russia - Moscow, Yekaterinburg, Izhevsk, Tula, Ryazan, Vologda and others. In Siberia, he works in Novosibirsk, Krasnoyarsk, Omsk, Tomsk, Kemerovo and Tyumen.

Loko-Bank is suitable for a newly registered individual entrepreneur.

The bank offers the entrepreneur everything he needs.

Quite a large and stable bank.

Loco-Bank is not present in all cities of the country.

- Cost per month for free

- Opening cost for free

- Cost of payment order 59 rubles

- Transfers to individuals from 2% to 10%, to a personal bank account - free

- Internet banking yes (support for new browsers, including Safari for Mac)

- SMS notification 250 rubles per month

- iOS app There is

- Login to Internet Banking USB key

- Cash withdrawal from 3% to 15%

- Account registration online with a specialist visiting

- Bonuses when opening an account No

Advantages

- An account is opened without visiting the bank

- Free account opening and maintenance

- Cash replenishment through a large network of partners

- Participation in government support for SMEs

Flaws

- Sometimes operations take a long time

6th place. Expert Bank. Tariff "Economy Online"

6th place

Expert Bank offers a current account with free servicing, interest on the balance, but rather expensive payments. You can open an account here without visiting the bank, and you will receive the details after completing the application. When you sign up for this tariff, you will have access to all additional services and offers. The bank is small, but quite stable and reliable. There’s definitely no need to be afraid of your license being revoked in the near future.

The main branch of the bank is located in Omsk. He also serves clients from Moscow, St. Petersburg, Kazan, Yekaterinburg, Novosibirsk and 7 other cities.

Expert Bank is suitable for a newly registered individual entrepreneur.

You can open an account without visiting the bank.

The bank offers the entrepreneur everything he needs.

Expert Bank maintains a sufficient level of reliability.

Internet banking is compatible with services from 1C.

- Cost per month for free

- Opening cost for free

- Cost of payment order 85 rubles

- Transfers to individuals from 1% to 2.5%

- Internet banking There is

- SMS notification for free

- iOS app There is

- Login to Internet Banking login and password or USB key

- Cash withdrawal from 1% to 6%

- Interest on balance up to 1.5% per annum

- Account registration online with a specialist visiting

- Bonuses when opening an account 1 month accounting services as a gift; free express audit of company accounting; 45 days of free use of the 1C-Reporting service

Advantages

- Interest on account balance

- Free opening and maintenance

- Loans, guarantees and overdraft for business

Flaws

- Account processing may take a long time

- Expensive payment orders

7th place. Sovcombank. Tariff "Start"

7th place

Sovcombank is a large bank that has become popular due to its offers for pensioners and the Halva installment card. It also actively serves small businesses. An account at Sovcombank is quickly opened using a passport. The starter plan offers free service and low-cost payments.

There are Sovcombank branches in almost all major cities of the country - from Moscow and St. Petersburg to Yakutsk and Khabarovsk. You can open an account at any of these branches.

An account with Sovcombank is suitable for a beginning entrepreneur.

To open an account, you only need a passport.

The bank offers entrepreneurs a variety of services.

One of the largest private banks in the country.

Clients have access to free internet banking.

- Cost per month for free

- Opening cost for free

- Cost of payment order 50 rubles

- Transfers to individuals salary - 1%, other - from 1.4%

- Internet banking yes, free. Supports all browsers on any device (tablet, laptop, computer, or phone) without a dongle

- SMS notification for free

- iOS app There is

- Login to Internet Banking login and password along with SMS confirmation

- Cash withdrawal up to 50,000 rubles - free, then - from 2.5%

- standard - 500 rubles per year, Halva - 1,999 rubles per year

- Account registration online with a specialist visiting or at a bank branch

- Bonuses when opening an account No

Advantages

- Free account opening and maintenance

- Issue of Halva cards in the salary project

- Overdraft up to 10,000 rubles when opening an account

- Various types of acquiring and online cash registers

Flaws

- High fees for cash transactions

8th place. Raiffeisenbank. Tariff "Start"

8th place

A foreign bank that inspires trust. Originates from Austria and is considered one of the most reliable banks in Europe. Competent and polite operators in the call center. Positive reviews on forums. For beginning entrepreneurs, Raiffeisenbank offers a simple tariff with inexpensive services.

Basically, Raiffeisenbank operates in the European part of Russia. In Siberia, the bank is present in Novosibirsk, Omsk, Surgut, Krasnoyarsk and several other cities.

The bank is more suitable for an actively growing individual entrepreneur.

The account is opened at a bank branch.

Vanguard offers businesses many different services.

Large and reliable international bank.

The bank develops its own remote banking systems.

- Cost per month 990 rubles

- Opening cost for free

- Cost of payment order 25 rubles

- Transfers to individuals up to 700,000 rubles - free, then - from 1%

- Internet banking yes (support for new browsers, including Safari for Mac)

- SMS notification 190 rubles

- iOS app for free

- Login to Internet Banking USB key

- Cash withdrawal from 1% to 10%

- Account registration online with a specialist visiting or at a bank branch

- Bonuses when opening an account No

Advantages

- Inexpensive payment orders

- Various services for foreign trade

- Loans, guarantees and overdraft for business

Flaws

- Expensive service per month

9th place. ForBank. Tariff "Initial"

9th place

An increasingly popular bank from Moscow is actively developing services for small businesses. For individual entrepreneurs, ForBank offers an account with free service, built-in accounting and a variety of business services. Another interesting offer is a corporate card with cashback for any expenses paid for it.

Entrepreneurs from Moscow, Smolensk, Novosibirsk, Barnaul and several other cities can open a current account with ForBank.

A free current account is available at ForBank.

The account is quickly opened without visiting the bank.

The bank offers small businesses a variety of services.

ForBank maintains a sufficient level of reliability.

Online accounting is built into the Internet bank.

- Cost per month for free

- Opening cost for free

- Cost of payment order 75 rubles

- Transfers to individuals free up to 100,000 rubles to an account in ForBank, to other banks - from 1%

- Internet banking yes (support for new browsers, including Safari for Mac)

- SMS notification 250 rubles per month

- iOS app There is

- Login to Internet Banking login and password along with a USB key

- Maintenance and issue of corporate cards for free

- Cash withdrawal from 1.5%

- Additionally online accounting - from 650 rubles per month

- Account registration online with a specialist visiting

- Bonuses when opening an account No

Advantages

- Free account maintenance

- Built-in Internet accounting

- Free business card with 1.5% cashback

- Assistance in registering a business

Flaws

- This tariff does not allow for transactions with foreign currency.

10th place. Vesta Bank. Tariff "Startup"

10th place

An actively developing bank that aims to work with small businesses. Offers all the necessary services to both entrepreneurial clients and their employees. A small individual entrepreneur will benefit from a tariff with free service, quick account opening and free transfers to accounts in the same bank. You don't need many documents to open an account.

The bank has branches in 12 cities - in Moscow, Krasnodar, Novosibirsk, Omsk, Kazan and others. The bank serves clients both in offices and through field specialists.

The account is opened and maintained free of charge.

The account is opened within a day without visiting the bank.

Almost all necessary services are available to the bank's clients.

Vesta Bank maintains a high level of reliability.

To open an account you do not need a large package of documents.

- Cost per month for free

- Opening cost for free

- Cost of payment order 89 rubles

- Transfers to individuals to an account in Vesta Bank - free of charge, to other banks - at the cost of payment

- Internet banking yes (support for new browsers, including Safari for Mac)

- SMS notification 49 rubles

- iOS app for free

- Login to Internet Banking login and password or USB key

- Cash withdrawal from 1.5% of the amount

- Account registration at a bank branch

- Bonuses when opening an account No

Advantages

- Free account maintenance

- Merchant and mobile acquiring

- Services for payroll clients

- Inexpensive SMS notifications

Flaws

- Expensive payment orders

11th place. VTB. Tariff "Start"

11th place

One of the largest banks in the country - in size it is close to Sberbank. I have been following his products for a long time - both for private clients and for business. Cash settlement services at VTB are very expensive, but offer a large number of additional services - from loans to online cash registers. This offer is suitable for those for whom the reliability of the bank is more important than favorable conditions.

The bank is present in many cities throughout Russia - Moscow, Yekaterinburg, Voronezh, Perm, Ufa and others. In Siberia, he works in Novosibirsk, Omsk and Tyumen.

VTB is more suitable for a stable individual entrepreneur.

The account is quickly opened at the bank branch.

The bank provides all the services small businesses need.

One of the most reliable banks in Russia.

The bank will help you register your business.

- Cost per month 1,200 rubles

- Opening cost up to 3,000 rubles

- Cost of payment order 5 per month - free, then - 100 rubles

- Transfers to individuals up to 150,000 rubles - free, then - from 1%

- Internet banking There is

- SMS notification 100 rubles per month

- iOS app There is

- Login to Internet Banking USB key

- Cash withdrawal from 1% to 10%

- Account registration at a bank branch

- Additionally business registration services

- Bonuses when opening an account No

Advantages

- Assistance in registering a business

- Salary Multicards for employees and managers

- Various services for foreign exchange transactions

- Various types of acquiring and online cash registers

Flaws

- Expensive maintenance per year

- Paid account opening possible

12th place. Sfera Bank. Tariff "S"

10th place

A project by BCS Bank, known for its investment services. The sphere does not have its own offices and serves clients online. The bank is interesting because of its built-in accounting for entrepreneurs using the simplified tax system and an account with free servicing. However, its overall range of services for business is still small

Sphere services are available in any city where there are BCS branches. The bank is present in Moscow, St. Petersburg, Novosibirsk, Kaliningrad, Perm and other cities.

The sphere is quite suitable for a small individual entrepreneur.

The account is issued without visiting the bank.

Sphere clients have access to simple accounting and online cash registers.

BCS maintains a high level of reliability.

Internet banking works on any device.

- Cost per month for free

- Opening cost for free

- Cost of payment order 90 rubles

- Transfers to individuals free up to 100,000 rubles, then from 1.5%

- Internet banking There is

- SMS notification for free

- iOS app No

- Login to Internet Banking login and password, and then a choice of SMS confirmation or key fob with code

- Cash withdrawal from 1.5% to 15%

- Additionally free accounting for individual entrepreneurs using the simplified tax system, free electronic signature

- Account registration online with a specialist visiting

- Bonuses when opening an account 3 months of access to the ECAM inventory system, number 8-800 and 2 months of free telephony from MTT, 30 days of free job posting on hh.ru

Advantages

- Assistance in registering a business

- Free account maintenance

- Free built-in online accounting

Flaws

- Expensive payment orders

- Large fees for cash transactions

13th place. Eastern Bank. Tariff "Your Start"

13th place

A large bank with a large network of branches, especially common in Siberia and the Far East. Offers quite convenient conditions for a current account. It is best to pay for services several months in advance - then the bank will give you a discount of up to 20%. The bank offers all the necessary services for business - from loans to bank guarantees.